capital gains tax increase effective date

If this were to happen it may not. The 2021 estate tax exemption threshold is 117 million per individual indexed for inflation with a top tax rate of 40 percent.

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

9 and racing against a Sept.

. Estate and Gift Tax Changes. It is expected that the long-term capital gains tax rate change will be effective the day it is agreed to and announced with little to no advance warning. The House proposes that its capital gains increase apply to sales on or after Sept.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. If a capital gains tax increase is enacted advisors will encourage many clients to try and sell assets as soon as they can. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

KPMG Catching Up on Capitol Hill Podcast Episode 13-2021 Its not just the how much the capital gains tax rate may increase its the when. It would be important to watch the effective date. June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive.

Long-Term Capital Gains Taxes. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. Additionally a section 1250 gain the portion of a gain.

27 deadline there could be imminent action triggering an effective date tied to an upcoming date. With tax writers launching mark-ups as early as Sept. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the.

Hawaiis capital gains tax rate is 725. Dems eye pre-emptive capital gains effective date. Capital gains tax rates on most assets held for a year or less.

In some cases your goal might be to reduce your income to below tax thresholds like 400000 of income or 1 million under a separate proposal to raise the capital gains tax. There is currently a bill that if passed would increase the capital gains tax in. The rates do not stop there.

If adopted this proposal would likely be. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. 4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25.

Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. 13 2021 unless pursuant to a written binding contract effective on or before Sept. That applies to both long- and short-term capital gains.

In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million. June 9 2021 Bernie Kent JD CPA PFS It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. The current estimate of.

The proposed effective date is for taxable years beginning after december 31 2021. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987.

This Is Exactly How I Passed Principles Of Tax In A Month Sophie Winter Revision Guides How To Memorize Things Principles

Effective Performance Testing Is Critical To Ensure Applications Run Without Any Downtime Join Us For A Live Webinar And Ga Webinar Software Testing Solutions

Gst Registration Return Filing Invoicing Ai Accounting Made Easy In India Providing Both Software Tax S Tax Services Accounting Software Online Accounting

Capital Gains Tax What Is It When Do You Pay It

Extends The Due Date For Filing Of Income Tax Returns From 31st July 2019 To 31st August 2019 Income Tax Return Tax Return Income Tax

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

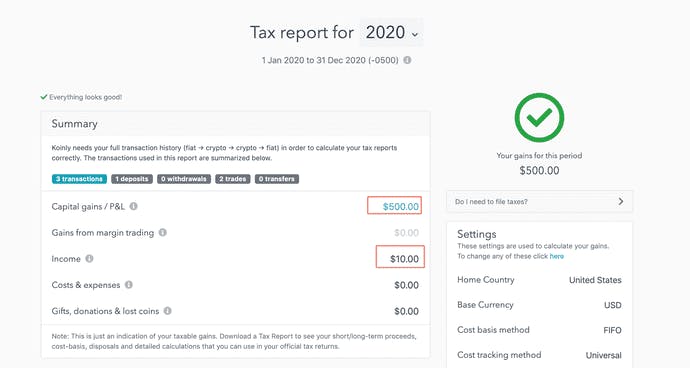

Germany Crypto Tax Guide 2022 Koinly

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

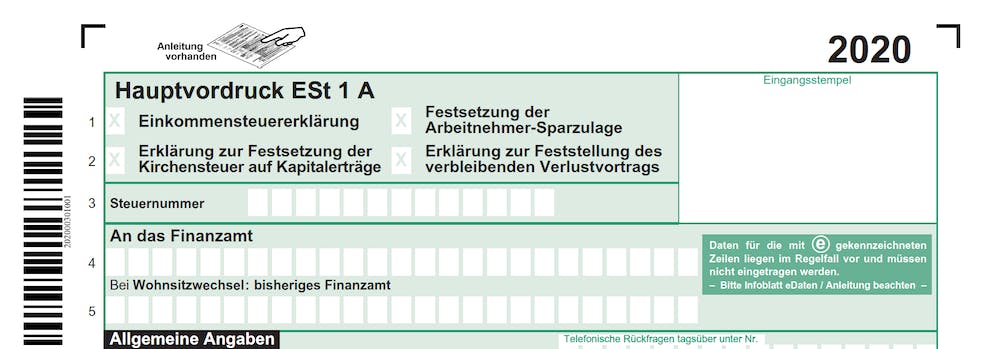

Income Tax In Germany For Expat Employees Expatica

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax Spreadsheet Australia Budget Spreadsheet Excel Spreadsheets Templates Spreadsheet Template

Good Health Is Wealth Annuities As Well As Tax Obligation Annuity Tax Tax Money

Penalty For Filing Taxes Late How To Prevent Https Www Irstaxapp Com Penalty For Filing Taxes Late How To Filing Taxes Tax Write Offs Tax Quote

Due Dates Income Tax Return Due Date Taxact

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Germany Crypto Tax Guide 2022 Koinly

Rent Roll Overview Nyc Hauseit Nyc Real Estate Real Estate Investing Nyc