vermont income tax rate 2020

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. RateSched-2020pdf 11722 KB File Format.

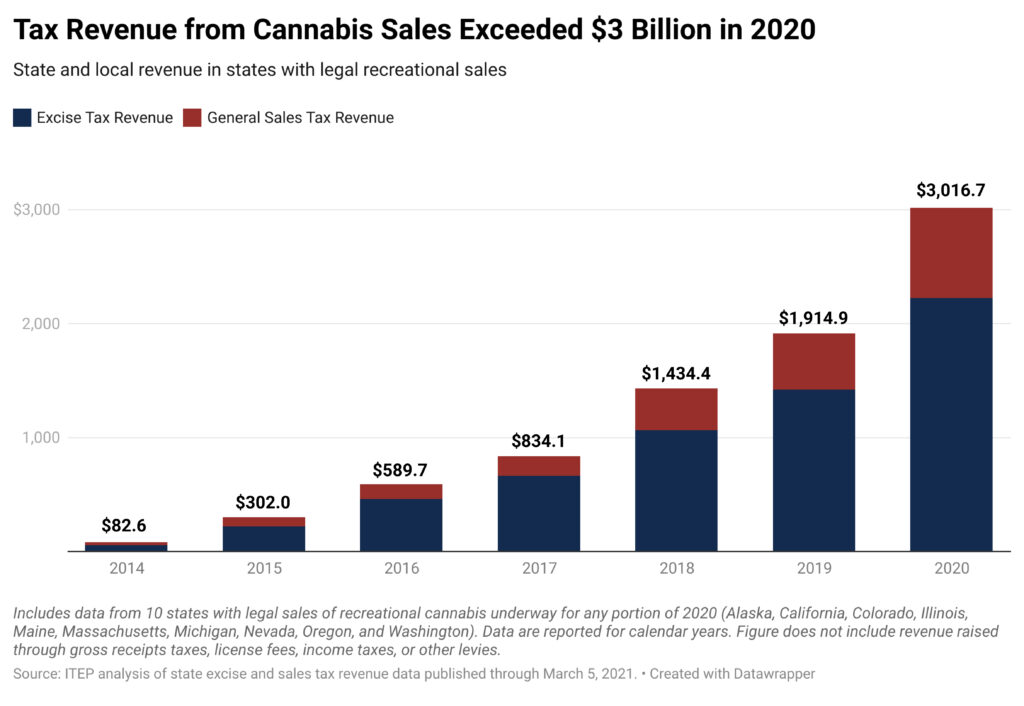

State And Local Cannabis Tax Revenue Jumps 58 Surpassing 3 Billion In 2020 Itep

Find your pretax deductions including 401K flexible account.

. According to the JFOs Ten Year Tax Study in 2015 with the top tax bracket of 895 the. The exact brackets will change slightly due to Arkansas policy of inflation-adjusting its brackets annually. There are -879 days left until Tax Day on April 16th 2020.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66. How to Calculate 2020 Vermont State Income Tax by Using State Income Tax Table. In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget.

Monday February 8 2021 - 1200. Vermonts rate schedules are designed to maintain at least 15 years of funding if no additional taxes are paid. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent.

The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax. Find your income exemptions. 31 rows The state supplemental income tax withholding rates that have thus far been released for 2020 are shown in the chart below.

Changes from 2019 are highlighted in yellow. The Vermont Single filing status tax brackets are shown in the table below. Vermonts income tax brackets were last changed two.

The previous 882 rate was increased to three graduated rates of. Tax Year 2020 Personal Income Tax - VT Rate Schedules. The Vermont income tax is a tiered rate tax which by its nature is a progressive tax.

Arkansas Individual Income Tax Rates 2020 Note. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017Vermonts tax brackets are indexed for.

Vermont Income Tax Rate 2020 - 2021. Vermont also has a 600 percent to 85 percent corporate income tax rate.

Vermont Income Tax Calculator Smartasset

These States Have The Highest And Lowest Tax Burdens

State Budgets Are So Flush Even Vermont California Progressives Are Cutting Taxes

Vermont Income Tax Calculator Smartasset

What Is Behind Montpelier S Property Tax Rate The Montpelier Bridge

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Lowest Highest Taxed States H R Block Blog

State Corporate Income Tax Rates And Brackets Tax Foundation

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

2022 Eligibility Tables Vermont Health Connect

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Vermont Income Tax Brackets 2020

Personal Income Tax Department Of Taxes

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

The 10 States With The Highest Tax Burden And The Lowest Zippia